Portugal Tax System for Expats

To get started with the tax system in Portugal, you will need to get a NIF. "Número de Identificação Fiscal" is how we call the Portuguese tax number.

How To Get A NIF?

To get a Portuguese NIF you will need to go to a Local Tax Office.

They will ask for your passport or other identification documents. You will also need to fill out some forms with information about yourself.

What's Next?

After getting a NIF, individuals must register as a taxpayer in order to file and pay taxes in Portugal.

This can be done through the Tax Authority's website, where personal information such as name, tax address, bank account number, and other details must be provided.

Once registered, individuals need to submit their annual tax return by the end of June each year in order to calculate any taxes due or any refunds they may be owed.

If taxes are owed, these should then be paid by the end of December of the same year.

Additionally, individuals should also pay estimated taxes during the tax year which are calculated based on income earned from different sources including employment or business activities.

Attention!

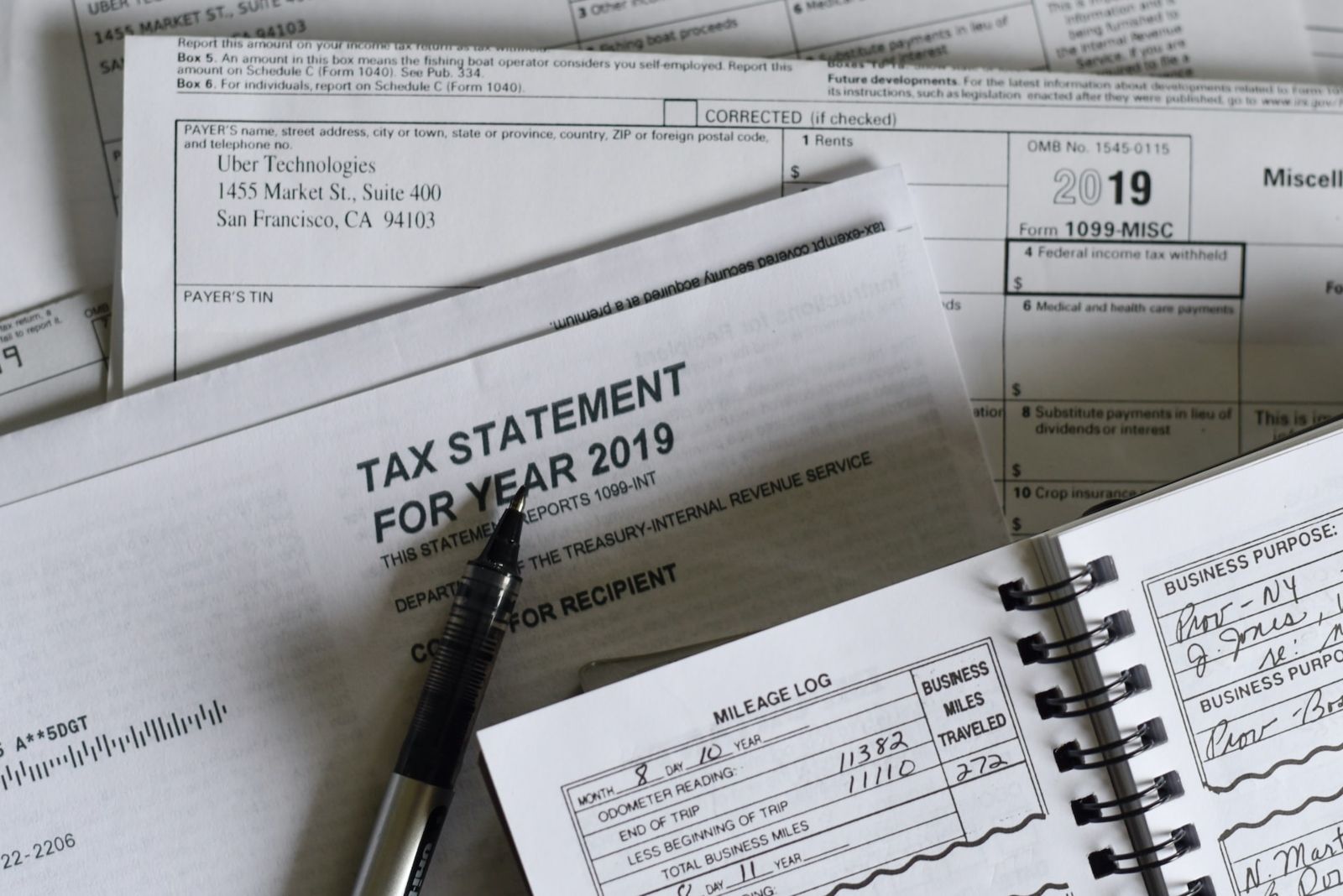

The tax rules for expats are quite simple to navigate. But taxpayers must keep accurate records of their income and expenses in order to file their income tax and returns accurately and minimize any potential fines or penalties that could be incurred - you should consider any rental income, investment income, pension income, professional income, and self-employment income.

It is also important to note that Portugal has very strict laws when it comes to filing taxes late and paying taxes late; if not done correctly you may be subject to fines or even criminal charges.

For expats living in Portugal, understanding and adhering to the country's taxation rules is key to avoiding financial penalties or legal issues down the line.

Who Has To Pay Tax In Portugal?

In Portugal, anyone who is a resident of the country for more than 183 days in the calendar year is considered a Portuguese tax resident and is required to pay tax in Portugal in that tax year.

This includes both citizens and expats, who must pay their income tax and any assets taxes they own or are entitled to in Portugal.

In addition to personal income tax, individuals may also be liable for other types of taxes such as capital gains tax or wealth tax.

Non-residents may be subject to taxes depending on their specific activities in Portugal and should consult with a qualified tax advisor if they have any questions.

Which Income Is Subject To Taxes?

Foreign income earned by expats in Portugal is subject to taxation. This includes any income generated outside of Portugal, such as employment or business activities, which must be declared on the taxpayer’s annual tax return.

Any income from abroad which is not reported or omitted from the tax declaration is subject to a 25% penalty rate.

Income earned within Portugal, such as wages from employment or profits from business activities, are taxed based on a progressive tax system.

Generally, tax residents with an annual taxable income of up to €7,490 are exempt from paying Portuguese income tax on their worldwide income. However, if their taxable income exceeds this threshold then they will be subject to taxation at different rates depending on the amount earned.

Expats in Portugal should also ensure that they claim any relevant tax deductions which may apply to them in order to maximize their after-tax earnings.

For example, individuals who are employed can claim a deduction against their salary up to 30% and those who are self-employed can deduct certain expenses related to running their business such as travel costs and materials purchased (up to a certain limit). In addition, certain types of pension contributions may also be deducted from taxable incomes.

Finally, it is important to note that all Portuguese residents must declare any foreign assets they own (bank accounts/shares, etc.) with a value greater than €50k as part of their annual tax return. Those who fail to do so could face high penalties or even criminal charges.

NHR, The Portuguese Tax System For Expats

The Non-Habitual Resident system in Portugal is an attractive option for foreigners who are looking to benefit from advantageous tax treatments.

The scheme is designed to attract highly-skilled individuals in the fields of science, technology, business, and the arts, as well as investors, entrepreneurs, and retirees.

It grants new residents a special tax regime that allows them to enjoy preferential income tax rates on their foreign-sourced income while living in Portugal.

Under the Non-Habitual Resident Scheme, expats who become Portuguese citizens after having lived out of the country for at least six consecutive years are eligible to pay taxes at reduced rates on their foreign-sourced income over a 10-year period.

This includes wages earned abroad and profits from investments or business activities outside of Portugal. Those who qualify for this status do not have to pay any taxes in Portugal on income earned within the country during this 10-year period.

Exemptions

In addition to reduced income taxes, the NHR system also allows expats to apply for exemptions from certain other taxes such as wealth, inheritance, gift taxes, capital gains tax as well as social security contributions paid by employers. Additionally, pension contributions made by qualifying individuals may be deducted up to certain limits when calculating their taxable incomes.

How To Claim The Benefit?

To take advantage of the NHR scheme, applicants must meet certain requirements such as registering with the Portuguese authorities within three months of becoming a resident and submitting an annual declaration each year before June 30th confirming their eligibility for the scheme. Qualifying individuals may also need to provide additional documentation such as proof of residence or evidence of their professional qualifications in order to successfully obtain NHR status.

Conclusion

Overall, the Non-Habitual Resident program provides an ideal solution for expats who are looking to enjoy favorable taxation benefits while living in Portugal without sacrificing any existing financial benefits they may have gained from sources abroad. It is therefore important that those interested in taking advantage of this scheme consult with a qualified professional advisor about their individual eligibility requirements before applying for it.

We recommend looking for tax advice from a tax professional, to fully understand the Portuguese tax authorities, the Portuguese taxes, the Portuguese tax year, inheritance tax, tax exemptions, social security taxes, double taxation, capital gains, and tax benefits.

After talking to an accountant or tax expert, you will have a personal overview of the program and will be able to take your own conclusions!