Our Complete Guide to the Portugal Golden Visa

Golden Visa Community is a free site for Golden Visa seekers to help each other by sharing experiences and leaving unbiased reviews.

We constantly collect information from industry insiders to keep this article up to date.

Here you can find a single destination to learn everything you need to know about Portugal's Golden Visas and how to get one.

The hype around Portugal has been hard to miss. Near-constant sunshine, Mediterranean food & wine, great surf, and "3rd Safest Country in the World" will get you noticed! But another reason is Portugal’s Golden Visa program - and quite rightly so.

Pro Tip

Keep an eye out for the Pro Tips left throughout the site to learn some golden nuggets of information and common pitfalls to avoid.

The Portugal Golden Visa sits comfortably at the top of the favorite list for global citizens looking to secure a powerful passport and it’s easy to see why:

- Only requires 7 days per year in Portugal

- Apply for citizenship after only 5 years

- Portuguese citizenship comes with rights to live and work in Europe’s 26 Schengen countries, including Germany, France, Italy, Sweden, etc

- Passports can be inherited by all future descendants

- This provides your family with an enduring legacy of access across all these European countries, including access to their job markets, free healthcare, and free education systems

- Modest investment of €280k - €500k which (if responsibly managed*) should come back to the investor with a profit

*This website exists to increase the probability of achieving this!

What's in the Article?

This article will take you on a deep dive into the Portugal Golden Visa program, covering the following sections:

1. A Quick Start Guide: Golden Visa in 10 Questions

2. Asking: Do you really need one?!

3. THE PORTUGAL GOLDEN VISA GUIDE:

i) Part 1: Investment Options

ii) Part 2: Professional Partners

iii) Part 3: The Practical Process

Portugal’s Golden Visa program is held up as exemplary among "Residency by Investment" programs. With over 10,000 applications granted in the last 10 years, attracting over €6.5 Billion (with a “B”!!), there is no doubting the success of the program and the economic boost that has accompanied it.

The Portugal Golden Visa in 10 Questions

1. What is a Portuguese Golden Visa?

Answer: It's a Portuguese residency visa

- Other “normal” residency visas require you to spend more than 50% of the year living in Portugal. A Golden Visa, by contrast, is a special residency visa where you are only required to spend 7 days per year in Portugal. This unusually flexible condition is permitted in exchange for the Golden Visa holder investing in Portugal

- In summary: A Golden Visa provides investors with Portuguese residency without them having to relocate to Portugal

- More details on What is a Golden Visa?

2. Is a Golden Visa a Passport?

Answer: No

- A Golden Visa is a residency visa

3. Can I apply for a Portuguese Passport afterward?

Answer: Yes, you can ultimately apply for a Portuguese passport (one of the most powerful passports in the world)

- After holding any Portuguese residency visa for 5 years you become eligible to apply for a Portuguese passport

- There are other important eligibility requirements to meet (most notably a basic language test) but they are trivial by comparison.

4. Do I need to pass a basic Portuguese language test?

Answer: No, not for the Golden Visa

- If you plan to apply for citizenship, then you eventually will

- The test is A2 level (enough for a basic exchange at the supermarket checkout), and you must score around 50% on the test

- You can take this test at any point during the 5-year period

5. How long does it take to get a Portugal Golden Visa?

Answer: Officially it takes 5 years

- In practice, you should budget a year of bureaucratic delay of 1 year at the start and the same at the end. Therefore, 7 years is a prudent projection

- We tend to refer to a 7-year process in our articles

6. Can my family (partner, child, parent) get passports via my Portugal Golden Visa application?

Answer: Yes

- Spouse: Yes (non-married partners qualify as well)

- Children: Yes, if they’re under 18 or are still “dependents”

- Parent: Yes, if they’re over 65 and are “dependents”

7. Is the Portugal Golden Visa the right solution for me?

Answer: A Golden Visa could be ideal for an individual who fits all of the following criteria...

- Wants Portuguese residency or wants to ultimately obtain Portuguese (or Schengen zone) citizenship

- Can afford to invest between €280k - €500k for approximately 7 years.

- Has a clean criminal record

- Can spend 7 days per year in Portugal

- Prefers not to relocate to Portugal in the next few years

- If you are happy to relocate to Portugal you should read about a D7 visa

8. What are my Golden Visa investment options?

Answer: There are two main routes to a Portugal Golden Visa:

- ROUTE A) Licensed & Regulated Investment Funds

- 7-year term

- €500k investment

- 1-2 month subscription period

- Lawyer & government fees are approximately €10k-30k (family size dependent)

- Approx. annual revenue: 0% - 7%

- Approx. annual costs: 2% (management fees)

- Approx. net annual profit 1-4%

- 0% tax on profits in Portugal

- Some funds are high-quality and attractive, some are new and under-captalized (many caveats)

- ROUTE B) Direct Purchase of Real Estate

- 7-year term

- €500k, available in restricted regions* (reduced to €400k if low population density region*)

- €350k, available in restricted regions*, must refurbish an old property (reduced to €280k if low population density region*)

- 1-3 month purchase period

- Lawyer & government fees around €10k-30k (family size dependent)

- Approx. annual revenue: 5%

- Approx. annual costs: 5% (broker fees, management fees, stamp tax, rental income tax, capital gains tax, etc)

- Approx. net annual profit 0%

- Most real estate is overpriced but some may perform well (many caveats)

9. Can American citizens apply for a Portugal Golden Visa?

Answer: Yes, although USA citizens must be aware of which investment options are PFIC compliant

- There are funds that are appropriate for US investors. This means they are volunteering to cover the cost for PFIC certificates which their US investors require to file their US tax returns.

- Some funds in the market claim to be USA-compliant but don’t obtain PFIC certification. So, check with the fund managers!

10. Who should I hire to get a Portugal Golden Visa?

Answer: a Portuguese lawyer

- Your Portuguese lawyer will be your all-important guide. Research well and choose wisely!

- A slick website is not a guarantee of good service!

- See lawyers' ratings and reviews from Golden Visa Community members

- An "advisor" or “intermediary” (a hand-holding service that tries to smooth your path)

- These are strictly optional: Some are helpful and some are harmful - beware. (many caveats)

- A Portuguese bank manager

- Opening a Portuguese bank account is a legal requirement. Your lawyer will arrange this for you.

- See banks' ratings and reviews from Golden Visa Community members

- If you choose the Direct Purchase of Real Estate route: A buying agent

- Optional, but strongly advised

Bonus Question: Where can I learn more about service providers, red flags, and reliable investments in Portugal?

Answer: Here at Golden Visa Community, of course!

- Read this (long!) article

- Visit our Articles

- Explore the Education section of this site

- Read below to learn about each type of stakeholder.

History & Social Context

In 2011, rocked by the global financial crisis, Portugal requested and received a national bailout. A need to attract new revenue streams led to the launch of the Golden Visa program (alongside other new fiscal policies) in 2012 which, at the time, focused solely on the sale of real estate to foreign individuals

The economic need was to generate revenue to service the country’s debt. The social hope was that foreign investment would trickle down into other sectors of the economy.

The Portugal Golden Visa program was a great fiscal success - the bailout program was concluded within three years. As a side effect house prices in coastal regions and major cities were sent soaring - between 2012 and 2019 high-end property values in Lisbon doubled - with the effect rippling out to a lesser extent across the whole housing market.

While a rising housing market will enrich landowners, the pace of change has been problematic for the native-born population, many of whom can no longer afford to live in the neighborhoods their families have occupied for generations.

On the flipside, in its first decade (2012-2022) the Portuguese Golden Visa program attracted over six billion euros into Portugal. Accordingly, many remain staunchly in favor of the continuation - even the expansion - of the program.

Of course, this money is not in the public purse, it’s mainly locked up in privately owned property. It is hard to know how much has been generated for the economy. A reasonable estimate sits around 10-25% of this figure, shared primarily between taxes, developers, construction firms, real estate agents, and lawyers.

And so, Portugal finds itself in dispute, from neighborhood cafes up to the benches of Parliament, about the future of the Golden Visa program and its place in society. Politically, it’s a crude but fair generalization to say the Right is for Golden Visas and the Left is against, but don’t assume Right and Left map on to the Right/Left divide in your home country - Portugal’s politics are idiosyncratic and fascinating in their own way, and very different to any Anglo-Saxonic systems.

As a particularly interesting post-script to this story, a solution to this deadlock may be emerging of its own accord, if the political class has the wherewithal to run with it, which is to promote investments into funds that focus on Impact Investing - investments that have some social or environmental benefit. These funds already exist in the Golden Visa space and have proven popular with investors.

Portugal Golden Visa Story...so far...

The Golden Visa Market in Portugal has evolved through two distinct chapters, so far:

- 2012 - 2019: The Direct Ownership Real Estate years

- 2019 - present: Introduction of Investment Funds

2012 - 2019: The Direct Ownership Real Estate years

During these years Portugal’s Golden Visa program was narrow, funneling investors to direct purchase of real estate. Uptake grew exponentially with 2 visas granted in 2012, then 494 in 2013, and 1,526 in 2014, leveling off slightly below this number for the following years. Chinese investors dominated the market at first (with Brazilians trailing some way behind in 2nd place) although as transferring capital out of China became harder their market share dropped each year, replaced by a spread of other countries including Turkey and South Africa.

Purchases caused a boom in a new “Golden Visa industry” including an incredible proliferation in real estate agents which lasts to this day (Lisbon is dotted with an incredible number of low-grade single-store agencies or agents who don’t even have physical premises, excited to capitalize on the gold rush by brokering deals here and there and skimming off massive commissions).

Developers also realized they could suddenly sell property worth €400k for €500k (to meet the visa requirements), pocketing the difference. These were the glory years for those in the right place at the right time. Investors often knew they weren’t getting a good deal, but with the visa on the scale as well, they were happy enough to proceed.

Over time investors have become less tolerant and savvier, although more is needed to continue the trend of professionalization and transparency in the market - hence the launch of the Golden Visa Community.

Buying was concentrated in Lisbon, Porto, and the Algarve, all of which saw prices sent through the roof! It became necessary for the government to step in and reduce upward pressure on the real estate markets by introducing another separate route to the Portugal Golden Visa - investing in a fund.

2019 - present: Introduction of Investment Funds

Investors began to recognize the convenience of professional management and the significantly lower low taxes and fees due, relative to buying and selling property. At first, the only funds available focused on real estate, which was inevitable given the market was staffed exclusively by real estate professionals.

In 2021 two significant trends emerged that caused the fund investment route to take flight:

First and foremost, the Americans arrived. Most often motivated by social unrest in the USA, the number of US investors looking for a “Plan B” exploded between 2020-2021, and with them came a new level of sophistication in the market. US investors are used to structured products and money managers so, for those individuals, funds make sense.

Second, diversification of options. Funds focused on a broader range of industries started to open up offering exposure to agribusiness, life sciences, startups, and the Portuguese stock market. Combined with the realization that investors can hedge their bets by spreading their investments across more than one fund, the popularity of the route continues to grow quickly.

Investment Funds have doubled in market share every year since their launch, now accounting for 20% of Golden Visa applications, and growing.

This brings us up to the second significant regulatory change from the government trying to address the upwards pressure on the housing market. Most notably, as of 1st January 2022, it was no longer possible to obtain a Portuguese Golden Visa by direct ownership of residential real estate in Lisbon, Porto, the Algarve, and most of Portugal’s coastline (e.g. where prices have been pushed up too aggressively).

This short history of the Portugal Golden Visa Program brings us up to 2022 and a market finding a new equilibrium in the wake of these latest regulatory updates.

Is the Portugal Golden Visa the Right Solution for You?

Benefits of Portuguese Residency

Here are 15 very good reasons why Portuguese residency status (e.g. a Golden Visa) is one of the most attractive in the world:

- Freedom to live and work in Portugal

- Unlimited travel within Europe (26 Schengen Area countries)

- Free high-quality healthcare

- Free high-quality education

- 3rd Safest Country in the world

- Brilliant tax efficiency for foreign investors

- Mediterranean diet & low-cost phenomenal wine

- English speaking

- Voted best ex-pat quality of life in Europe (again!)

- Cheapest Cost of Living in Western Europe

- 300 days of sunshine per year

- Political Stability

- Beautiful Beaches (also world-class surfing waves)

- Breathtaking scenery

- Welcoming population

Is Portugal's Golden Visa better than comparable countries?

Of course, the primary objective of most Golden Visa seekers is to eventually receive a Portuguese (read: European) passport. This comes with the freedom to permanently live and work in any of the 26 European Schengen Area countries. On that basis, let’s compare other Golden Visa programs.

- Spain: €500k to purchase real estate. Live in Spain more than 183 days per year + basic language. 10 years.

- A recent tax on global wealth has hugely reduced the draw of Spanish residency for foreigners.

- Greece: €500k to purchase real estate. Live in Greece more than 183 days per year + fluency language test. 7 years.

- Malta: has many pathways, the cheapest requires €360k. No requirement to live there. €135k is non-refundable (taken by the government and fees). 5 years.

- Can also be completed in 1 year for €750k.

- Latvia: €250k to purchase real estate. Visit every year for 1 day to renew your visa. 10 years.

- Netherlands: €1.25M into a Dutch startup or VC fund. 5 years.

- Austria: €3M in government Development Fund. Unspecified timescale.

- Ireland: €1M in Investment Fund, or €500k non-refundable government donation. 3 years.

- Canada: €820k (CAD $1.2M) lend to government with 0% interest. 5 years. (permanent residence, not passport - ending in 2023)

- Various cheaper and quicker programs, e.g. Caribbean, Panama, Turkey: These are all cheaper for good reasons including a significantly diminished list of local benefits, worse security, and much lower overall power of the passport.

Portugal, by contrast, has the following terms:

- €280-500k in investment funds or real estate. Visit Portugal for 7 days each year (on average). Basic language test. 5 years.

- A Portuguese passport is the 4th most powerful in the world for visa-free travel.

So, having established that the terms of Portugal’s Golden Visa program are hard to beat, the next question is:

Within Portugal, is a Golden Visa the right solution for me?

Portugal offers many different types of residency visas and a Golden Visa may not be the right solution for you. Those who get paid to sell you a qualifying investment for a Golden Visa may be conspicuously quiet about your other options. By far the most popular alternative to a Golden Visa is a D7 visa.

Pro Tip

A D7 visa offers many of the same benefits as a Golden Visa and does not require making a large investment

The key difference is: for a D7 visa, you *do not* need to make an investment but you *do* need to reside more than half the year in Portugal.

For a Golden Visa, you must make an investment but you only need to reside 7 days per year (on average) in Portugal.

Portugal’s D7 Visa

Many of the requirements are the same for both residency visas - the timescale is the same and both count equally toward your eventual eligibility to apply for a passport.

A D7 requires you to live in Portugal whereas a Golden Visa does not.

In practice, a Golden Visa investment “buys'' you geographical flexibility in your life during the 5 years you’re “earning” your right to apply for a passport.

In more detail: one of the requirements to apply for Portuguese citizenship is to have completed 5 years of residency in Portugal. You can either complete that by actually residing in Portugal (D7 route), or you can make an investment (Golden Visa route) in exchange for the government waiving your need to be physically present in Portugal during those 5 years. The end result is the same.

If you’re looking to move to Portugal within the next 12-24 months anyway, you may want to consider whether it’s worth your while parting with all that cash to get a Golden Visa, when you could just wait until you move here and start the D7 process.

Some of the common reasons we hear from existing Golden Visa investors include the following:

- Plan to move to Portugal in 5 or more years from now

- Plan to move to Portugal in the medium term, but enthusiastic to get the 5-year residency clock started asap

- Plan to move to another European Union member state after achieving Portuguese citizenship

- No plan to move to Portugal but…

- Would like children and further descendants to inherit Portuguese citizenship

- Would like a passport for very smooth global travel

- Would like a geopolitically stable backup plan

- Would like to benefit from significant Portuguese tax perks

Know more about the difference between Golden Visa Program and D7 Visa.

What do I need to qualify for a Portuguese Golden Visa?

- Must make a “qualifying investment” (details below)

- Must not be from the European Union, European Economic Area, or Switzerland

- Must have a clean criminal record

- Must demonstrate a legitimate source of funds for the investment, with supporting paperwork

- e.g. salary, sale of assets, inheritance, etc

- Must tolerate some tedious paperwork: many forms, wet signatures, international postage:

- Choosing the right lawyer to assist your Golden Visa investment (see law firms here) is the best way to outsource the maximum percentage of the significant hassle. But be warned, you can’t outsource 100% of the hassle - it is surprisingly old-fashioned!

THE PORTUGAL GOLDEN VISA GUIDE PART 1: Investment Options

So, you’ve decided you want to get a Portugal Golden Visa… What now?

You need to make a “qualifying investment”. In theory, you have 10 options! In practice, most have never been utilized because they’re simply not attractive.

95% of Golden Visa investments are made into just 2 of these options: Investing in an Investment Fund and Direct Purchase of Real Estate. A distant 3rd in popularity is the Capital Transfer, which we touch on briefly below

Psychology of Golden Visa Investing

Pro Tip

Focus on minimizing risk, not maximizing profits!

Property developers, real estate agents, and fund managers are not legally bound by the returns they advertise. So don't pay much attention to these figures - which are unpredictable! - instead, focus on minimizing risk of losing the capital invested.

Ask yourself: If annual returns were 0% from a product, would you still feel safe storing your capital there to obtain a Golden Visa? If yes, you’re on steady ground. Alternatively, if you’re genuinely relying on projected profits to make this workable in your life then you might want to think again.

The profits coming your way will vary, regardless of what brochures say. Returns might be great but they also might be disappointing - you can’t be sure. That’s the nature of investing and this market is no different.

On this basis, wise investor focuses their analysis not on trying to find products that generate the highest profits, but on seeking those which have the highest chance of protecting capital, ultimately returning 100% of what was invested.

It’s not that you want to aim for a low bar of 0% returns, rather the considerations of risk and return should be examined individually.

First, consider: Am I happy with this risk profile assuming a 0% return; yes or no? Only if you’re sure the answer is yes should you then consider this solution, and weigh up projected returns against other options.

Making sure you get your original capital back should always be the top priority. After all, annual returns will not ease your pain if the project fails and your original investment shrinks significantly. Try to think of returns as icing on the cake.

In order to complete your analysis of any solution, it is crucial to understand how to analyze a Golden Visa investment fund for a low-risk profile and how to analyze whether a Golden Visa real estate investment is high-risk or low-risk.

QUALIFYING INVESTMENT "ROUTE A": The Portugal Golden Visa Investment Funds

The market has responded to the popularity of the Investment Fund route and to meet that demand a large number of Portuguese Golden Visa-eligible funds have opened up in the last 12-18 months.

Some funds are specifically designed to meet the needs of Golden Visa investors. Many of them are, frankly, non-viable and will not last, so it is important to understand what might cause a Golden Visa fund to close down and what that would mean for investors.

Like most markets, a small group of these funds stand out and hoover up 80% of the market. This is mostly for good reason, and this post will mainly focus on these more popular funds.

As of the regulatory changes on January 1st 2022, this route to a Golden Visa requires an investment of €500,000.

Six Benefits of Portugal Golden Visa Investment Funds over Purchasing Real Estate

1. Regulatory Protection for Investors

- Fundamentally, investment funds are regulated, and real estate purchase is not.

- Fund managers are licensed and regulated by the CMVM (Portugal's financial regulator, equivalent to the USA’s SEC or the UK’s FCA)

- This means they are subject to regular scrutiny by the regulator who watches every investment to ensure investors are suitably protected from unscrupulous activity.

- Funds are required to be externally audited every year (often by the Big Four)

- Real estate products are totally unregulated, meaning real estate investors enjoy none of the regulatory support that investors in funds received.

2. Professional Financial Management

- Fund managers employ professional risk analysts and investors

- When you purchase real estate, advice mostly comes from real estate agents who are employed to sell to you and usually have no financial education

3. Choice of Asset Classes

- Available funds in the market now covers a broad range of asset classes and industries including farmland, logistics, healthcare, Portuguese stocks, startups, and of course real estate development.

4. Spread Risk through Diversification

- Investment portfolios are diversified across numerous different investments, reducing the risk of being exposed to a single asset (such as a single property) or market

- You are also free to diversify your investment across numerous funds, further spreading the risk

5. Lower Taxes and Fees

- Funds sometimes charge a one-off subscription fee of around 1%, then an average management fee of approximately 1.5% per year. Tax on your profits is usually* 0%, making funds significantly more efficient

- Fees are very heavy with real estate ownership - if you buy and sell a property over a 5-year period, you will lose approximately 5% per year to taxes, fees, and agency commissions

6. Convenience

- No property search (which means no dealing with real estate agents)

- Less frustrating bureaucracy than purchasing a property

- “Set and forget”, no maintenance or management required during intermittent years

*Tax on profits from Portugal's Private Equity funds is 0% for individuals who are not tax resident in Portugal (Golden Visa investors are usually not tax resident in Portugal and so can benefit from this.) Any investors who are tax resident in Portugal pay only 10% tax on profits.

Understanding the Mechanics of Portugal’s Golden Visa Investment Funds

Before we look at the specific funds you can invest in it could be helpful to take some time to understand how these funds are put together. These are just a few bare essentials - to dig deeper we highly recommend our Definitive Guide to Understanding Golden Visa Eligible Investment Funds in Portugal.

Structure: Fund Managers & Fund Advisors

- Most of the funds in the market are a partnership of two principal stakeholders:

- Fund Manager: Handles the administrative duties, reporting to the regulator, liaising with auditors, risk analysis of prospective investments, and ultimate green/red lighting of investments

- Fund Advisor/Sponsor: The domain expert and the driving force behind the project. Responsible for originating investment opportunities and executing the core business plan, as well as raising capital into the fund. Usually investors in the fund themselves.

Regulation

- All funds which qualify as Golden Visa investments are certified and closely monitored by Portugal's financial regulator - the CMVM (equivalent to the SEC in the USA or the FCA in the UK).

Fees

- Funds tend to charge a 1-time subscription fee (approximately 1%), a fixed annual management fee (approximately 1.5%), and a performance fee (they differ but usually take a share of returns over a certain hurdle)

Returns

- Annual Returns: Some funds aim to provide an annual payout.

- Returns Upon Liquidation: When the fund closes, principle capital should be returned with a profit

Strategy/Activity

- These funds can only invest in companies. So, a fund that says it buys real estate actually invests in a company that owns (or intends to buy) real estate.

- Each fund’s investment strategy is unique but some basics to look out for are:

- Simplicity: do you really understand what they’re doing?

- Fragility: If economic conditions change how robust is the strategy?

- Internal dealing: is the fund buying/selling real estate from companies they’re also associated with? This can be a red flag as sitting on both sides of the table can lead to artificial pricing.

FATCA & PFIC Compliance

- USA investors beware…! Not all funds will do the additional work required to ensure they’re PFIC compliant and can provide the necessary information required for PFIC accounting. Be sure to check!

Portugal’s Golden Visa Investment Funds

- Pela Terra Farmland

- Risk minimizing strategy: Acquires stable farmland with water assets, generates rental income. Develops land for profitable sale.

- Minimum investment: €100,000 | Duration: 9 years | US-citizens: Yes | Subscription deadline: July 2023

- Hospitality Expansion Fund

- Focused on acquiring undervalued hospitality assets, fixing them through physical and management intervention, and exit them as premium high-margin operating assets.

- Minimum investment: €200,000 | Duration: 8 years | US citizens: Yes | Subscription deadline: December 2022

- Self Storage Fund I

- Investing in self-storage, the most resilient asset class in real estate.

- Minimum investment: €150,000 | Duration: 7+ years | US citizens: Yes | Subscription deadline: December 2022

- Tejo Ventures

- Blends Portuguese real estate and energy infrastructure with unparalleled venture deal access in the US, UK and Europe, limiting exposure to one single asset class, whilst maximizing returns.

- Minimum investment: €250,000 | Duration: 6+ years | US citizens: Yes | Subscription deadline: September 2022

- Iberian Student Living Fund

- Real estate developments of purpose-built student accommodation in the underdeveloped sector in Iberia.

- Minimum investment: €150,000 | Duration: 9 years | US citizens: Yes | Subscription deadline: May 2023

- Insight Fund

- Real estate renovation and hospitality projects with a focus on fixed income and capital preservation.

- Minimum investment: €200,000 | Duration: 12 years | US citizens: Yes | Subscription deadline: March 2024

- Fjord Capital

- High-end residential real estate.

- Minimum investment: €500,000 | Duration: 7 years | US citizens: Yes | Subscription deadline: May 2023

- Green Insight I

- Building a Responsible Future through Profitable Assets in Technology, Sustainability and Real Estate.

- Minimum investment: €50,000 | Duration: 8 years | US citizens: No | Subscription deadline: July 2023

Bring more funds to our attention here

QUALIFYING INVESTMENT "ROUTE B”: Direct Purchase of Real Estate

Direct purchase of real estate is the traditional route to a Golden Visa and in spite of funds increasingly encroaching on their patch, still dominates the market.

Pro Tip

Real estate buyers are not protected by financial regulation.

Real Estate is not considered part of the financial markets in Portugal. This means it does not fall under the responsibility of the CMVM (Portugal's financial regulator). In practice, this means that real estate sales professionals - agents and developers - are not held accountable for what they say to investors. Please bare this in mind while researching opportunities.

Regulations changed on January 1st 2022 to, theoretically, exclude over-popular parts of the country from the program. However, as is often the case in Portugal, things are not quite as they seem. There are significant “loopholes” in the legislation introduced to end Golden Visa real estate in Lisbon, Porto, the Algarve and coastal regions of Portugal.

Obtaining a Golden Visa through direct ownership of real estate is bound to remain popular in the near term thanks to investors from countries where regulators don’t always have investors' best interests at heart, meaning financial products and fund management are not yet normalized. These investors skew towards self-reliance and investing in something they can touch and own outright exclusively (even at less attractive prices). These factors are seen as risk mitigation which is debatable but not always unwise.

Overpricing and re-salability both pose significant risks to an investor trying to protect their capital. The ideal scenario is if you are looking for a house to hang onto in rural Portugal for 10-20 years, as this will reduce your price sensitivity. In that case, this route remains a strong option, as your Golden Visa investment can contribute to your lifestyle in a way that Participation Units in an investment fund can not.

Is Portugal’s Golden Visa Real Estate Overpriced?

Golden Visa property has earned a reputation for artificial pricing and with good reason.

One enabling factor for overpricing is the opacity of the market. Data is hard to come by in the Portuguese real estate market in general - central listing websites exist but they are fragmented, full of out-of-date or incorrectly listed information, and generally, a mess.

This means buyers are at an informational disadvantage. Historically, real estate agents and developers have been happy to capitalize on this information advantage at buyers’ expense.

Overpricing has calmed down a bit compared to the wild west days of 2012-2018 but it remains hard to find golden visa eligible property where the visa isn’t priced in. In practice, this means a buyer’s eventual profit is reduced, having paid too much in the first place.

Exit Strategy from Portugal’s Golden Visa Real Estate

Pro Tip

The single most important question for Golden Visa property buyers to ask themselves is:

"Will I be able to resell this property at the end of the Golden Visa program?"

This has become a particularly burning question since the most desirable markets (Lisbon, Algarve, etc) have been removed as an option.

The required investment for Portugal Golden Visa real estate is reduced to €280k in low-population density areas of the country (details below). Demand for property in these areas is very low by definition (hence the low population density!).

This raises serious questions about who exactly the current Golden Visa buyers are expecting will buy these properties from them in 7 years' time. How much of a hit will they take on price when this demand doesn’t appear?

Some developers are trying to get around this with "buy-back guarantees" and by aggregating multiple buyers together to create hotels, both of which are legally questionable but still proving popular with bargain-hunting buyers.

Pro Tip

Many Portuguese lawyers advise that guaranteed returns are illegal. Developers are still selling them and bargain-hunting Golden Visa seekers are still buying them. This does not mean the regulator won't come down hard on them in the coming years. Suffice to say, we wouldn’t advise our friends & family to go this route.

Available Options for Portugal’s Golden Visa Real Estate Investing

There are 4 investment options available to investors:

- No building work required: €500,000 investment: This is the default option. Any property (or combination of properties) costing at least €500,000 will let you and your family qualify for a Golden Visa. While it’s the highest entry price, properties on this option are more likely to be closer to fair market value.

- No building work required, low-density discount. €400,000 investment: The same as the €500,000 option except the property must be in a low-density area. Challenging to find a good deal since this is expensive for these areas. Risk of low/zero demand when you want to sell.

- Building work required. €350,000 investment: A cheaper option in return for refurbishing a property that is 30+ years old or is located in a designated rehabilitation zone. This option requires significantly more paperwork for approval and you’re less likely to find a good deal.

- Building work required, low-density discount. €280,000 investment: The same as the €350,000 options except the property must be in a low-density area. Challenging to find a good deal since this is expensive for these areas. Risk of low/zero demand when you want to sell.

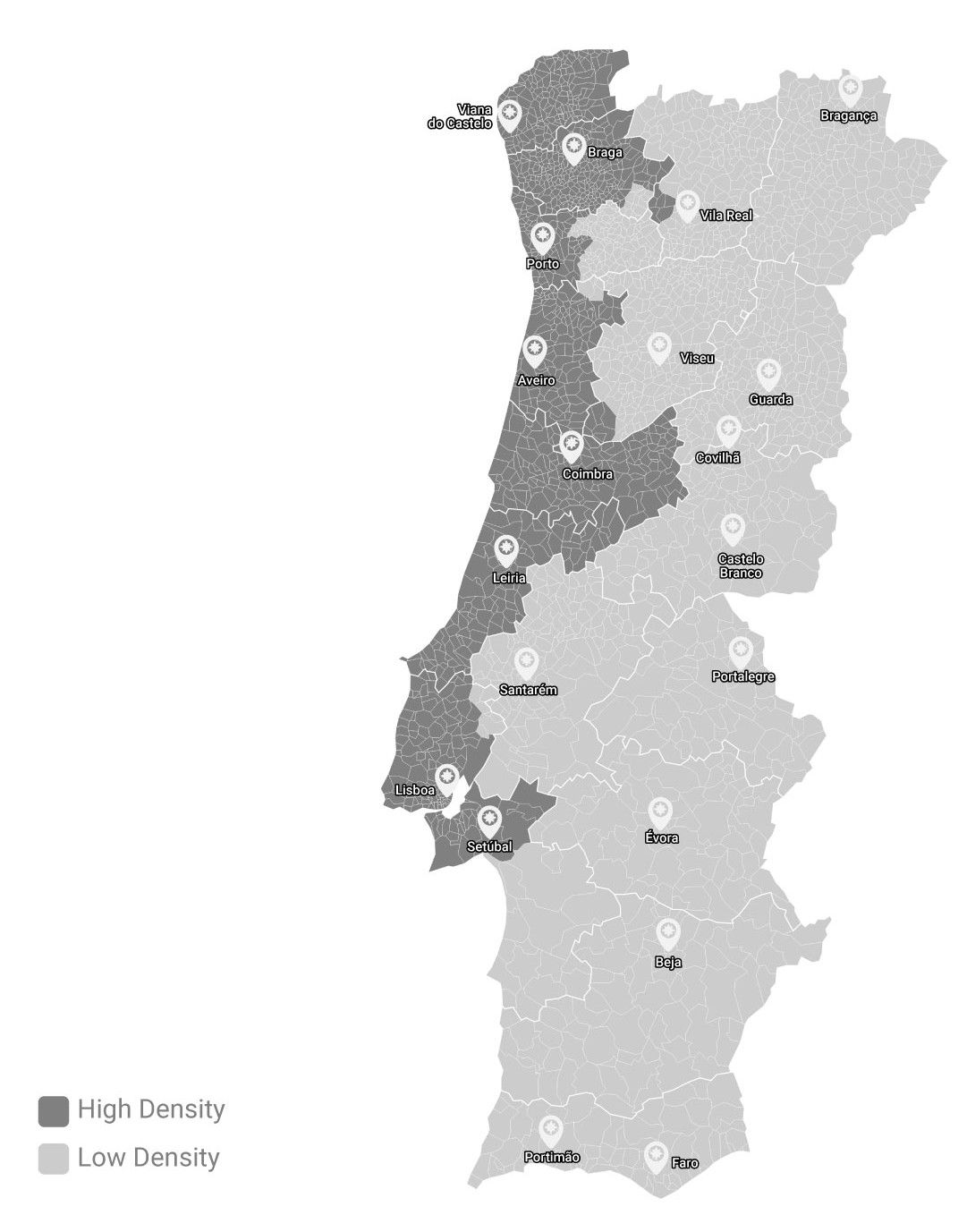

The Portugal Golden Visa 2022 Map

Portugal’s Golden Visa Map of Low-density Areas in Portugal, showing where the "discounted" regions are. In the low-density areas, where demand is low, the €500k GV can be obtained for €400k, and the €350k GV can be obtained for €280k.

Real Estate Agents in Portugal

A quick word on real estate agents in Portugal - be careful who you trust! This may sound harsh but this is an information piece and in this case, the truth isn’t pretty.

We know real estate agents have a challenging reputation globally so perhaps this isn’t newsworthy. But just remember to be extra cautious in Portugal. It has become routine for agents to exploit foreigners’ lack of local knowledge.

The property market has been booming for almost a decade, meaning low-grade operators have still been able to profit. This rising tide has made room for bad market practices to become the norm. High commissions are routinely charged for a shockingly bad service. Should you question the high price you’ll get the same response every time “that’s the norm in Portugal”. Enough said.

Real estate transactions are not legally part of the financial investment sector which means real estate agents - unlike investment fund managers - are not accountable to Portugal’s financial regulator (CMVM).

Pro Tip

Real estate agents are employed by the seller. It can be tempting as a buyer to feel that the helpful agent is there for you but they are not. An agent is paid to help their client, which is not you, it’s the person on the opposite side of the negotiating table.

Buying Agents in Portugal

Pro Tip

Consider hiring a “buying agent”. This is a professional to represent your side in the search and negotiations. They act on your behalf to scan the market (including accessing off-market opportunities) interact with the sales agents, filter out the nonsense, present quality options to you, handle the negotiation, and manage the convoluted sale process.

One prudent solution to the challenge of being a foreigner and going up against a local real estate agent is to hire a local buying agent, to represent your side.

Some examples of Buying Agents in Portugal:

- Active Search Portugal

- Bloom Spaces

- 11Pier

- Pearls of Portugal

- Property Finder Portugal

- Goldcrest

Property Developers: Buying off-plan

Another option you have is to buy direct from developers, rather than going through agencies.

To be clear, the developers will all have agencies built into their network of companies but it still removes one step. It goes without saying they'll give you the hard sell so be ready for that, but it is worth considering if you're committed to buying real estate.

You can, in theory, save money by buying off-plan. This means putting money down for a property that is still being built. The benefit - in theory - is that you pay today’s prices and by the time it's completed the price has increased. There is always a small risk that you hand over your money for a property that ever gets finished (famously exemplified by the Evergrande crisis in China, 2021). Nonetheless, this remains a popular option.

QUALIFYING INVESTMENT "ROUTE C": Capital Transfer

This is certainly the simplest “qualifying investment” (it’s not really an investment at all) for a Portugal Golden Visa seeker. All you need to do is transfer €1.5 million into a financial institution based in Portugal, which will then declare that you have done so, and you're done.

Undoubtedly the lowest risk option - good news for all those who can manage it!

Additional considerations include the fact that you’d get an almost zero ROI and you’d be hit hard by inflation. Also, if the value of the total drops below €1.5 million at any point this would invalidate your Golden Visa status, so you'd need to top up.

Unsurprisingly this is not very frequently utilized, but several investors have opted for it over the years, hence its inclusion here.

THE PORTUGAL GOLDEN VISA GUIDE PART 2: Who to Hire

You are obliged to open a bank account in Portugal, advised to use a lawyer in Portugal, and you may or may not choose to work with an intermediary service provider.

Pro Tip

A quality lawyer should serve a similar function to these additional service providers when it comes to visa applications and surrounding processes. Make sure you don’t pay twice for the same knowledge.

Choosing a Law Firm

Pro Tip

If you want accurate and up-to-date information you’ll need to speak to a good lawyer. Learning about how to complete an immigration process on a website will lead you astray. Things change in real time in Portugal. Websites don’t - even government websites will give you information that does not reflect what’s happening on the ground. Therefore, it is not wise to conclude anything about what you can or can’t achieve solely from internet research.

Context: Lawyers in Portugal

There are a huge number of lawyers in Portugal. This is because of the prevalence of bureaucratic processes which are not only complex and contradictory but also inconsistent. Just because A+B=C at one administrative window is no indication that this will be true at the adjacent window, or even at the very same window tomorrow (we mean this both metaphorically and literally).

Pro Tip

A law firm coming high up in Google rankings is not a reflection that they will serve you to a high standard, it only tells you they invested in their online marketing (search engine optimization).

Read what Golden Visa Community members thought of different law firms lawyers before hiring anyone.

A large part of what lawyers in Portugal do is to absorb the pain of these processes by navigating the labyrinth on your behalf and achieving the desired outcome efficiently.

Lawyers often have access to online portals and practical methods that are not available to members of the public. The good ones are also up to date on the ever-shifting goalposts of what is really needed to complete a process, how to present it, to who, and when.

You can get the answers to questions like this on websites, but because the reality on the ground is ever-shifting and sometimes doesn't reflect even the published regulation, a website will almost always be wrong, whereas a good lawyer will know today's reality.

Like many industries in Portugal, there are two “layers” of lawyers available: those aimed at locals and those primarily serving international clients. The former will be cheap but slow with very interesting ideas around customer service. The latter will be many times more expensive but they are the best people to manage a Portugal Golden Visa application.

That said, there are also firms in town that charge too much. The Golden Visa Community can help you to discern which law firms are genuinely good value.

Choosing an Immigration Lawyer

While you are not legally obliged to hire a lawyer, we are of the strong opinion that you are better off with a lawyer. Those who try to go it alone often give up and hire someone after expending their own time and effort.

In addition to time-sapping bureaucracy, another great reason to have an expert by your side is that there is often a significant disparity between what you might read on government or information websites and the reality of the requirements to complete a given process.

You need advice from experts on the ground on how best to complete your visa application. What you’re reading online will often not be accurate. This can be difficult to accept when you haven’t experienced it first hand but please save yourself the pain and take our word for it.

Checking a lawyer’s specialty is important. Your friend may recommend the lawyer they used to buy property but that doesn't mean they will be good for an investment fund.

We have seen numerous examples of reputable lawyers making mistakes on fund subscriptions because they’re only used to real estate. Ensure that the person you’re hiring has completed that exact job many times before.

The Golden Visa Community and the reviews left by your peers make up the best tool you have for checking whether a law firm is reliable.

Banks in Portugal

Do I need a Portuguese Bank account for a Golden Visa?

All the different visa programs in Portugal require you to open an account with a bank in Portugal, so… yes.

There isn’t a huge difference in the user experience of using the different banks. The larger retail banks all have acceptable mobile apps (the private banks, not so much - some are only in Portuguese, for example).

The price is relatively consistent - it will usually cost between €50 and €100 per year to have this bank account open. Some of the banks are amazingly indifferent about opening new accounts to secure new business, so what tends to happen is your lawyer will default to individual bank managers they already have a good working relationship with and who they know can act quickly and reliably. These individuals are usually situated at one of about six banks.

Retail Banks in Portugal

The main retail banks in Portugal are:

- BPI

- Caixa Geral de Depósitos

- Millennium BCP

- Novobanco

- Santander Totta

Of these, we see the majority of traffic going through Millennium, BPI and Novobanco.

There are others such as Banco Best and BancoBIC but they don’t feature in the market quite so much.

Private Banks in Portugal

Then there are the private banks. Again, a small number tend to secure the vast majority of business here. Those main players are:

- Banco Atlantico

- BiG (Banco de Investimento Global)

- Bison Bank

Other options include Banco Carregosa, Banco Finantia and Banco Invest, but again, they don’t feature heavily in the marketplace.

USA Investors, Take Note!

USA citizens who are investing in a Golden Visa Investment Fund must work with banks that are practicing FATCA compliance.

Although a large number of banks in Portugal meet the requirements, there are only a small number who have committed to actually doing the necessary reporting each year. Right now, that small number is only these three private banks listed above: Banco Atlantico, BiG and Bison Bank.

We have seen so many US investors receive bad advice, or do thier own research on misinformed websites, and go through the whole process of opening a bank account with Millennium or Novobanco, only to have to start all over again with one of these three.

THE PORTUGAL GOLDEN VISA GUIDE PART 3: Ten Steps to Achieving Portuguese Citizenship

The final part of our guide is the practical process of actually obtaining a Portugal Golden Visa and ultimately becoming a Portuguese citizen.

As long as you hire a good lawyer, all you really need to do is research your investment options, prepare your documents, fill in many forms and let your lawyer handle the rest. As long as you attend your biometrics appointment with the SEF and spend the required days in Portugal each year, you should have Portuguese residency within a few months, and citizenship in around 7 years.

Pro Tip

You can include a spouse (or life partner), unlimited numbers of your children (who are under 18 or are still “dependents'', and parents if they’re over 65 and are “dependents”) on your Golden Visa application as well, meaning they’re all on their way to becoming Portuguese citizens. There will be extra bills for each extra person but it is likely a price worth paying.

How to Get a European Passport in 10 Steps

** Starred steps can be completed by your lawyer

- Get your documents in order

- Hire a Portuguese lawyer

- Get a NIF **

- Open a bank account **

- Select your qualifying investment

- Complete your qualifying investment **

- Submit initial Golden Visa application **

- Attend SEF Appointment

- Complete Golden Visa renewals **

- Application for Citizenship **

Step 1: Get Your Documents in Order

Technically there are more documents than those listed here but your lawyer will source the others for you and ask you to sign at the right moment. The list here includes all documents that you are responsible for producing.

- Passport

- You can use a photocopy, so long as your Portuguese lawyer certifies that it’s genuine

- Proof of address in your home country

- Utility bill, less than 3 months old

- Portuguese lawyer will also certify that it’s genuine

- TIN (USA = SSN)

- Document showing your Tax Identification Number from your home country, e.g. tax return

- Some countries refer to this as your Social Security Number

- Employment letter

- A letter from your employer certifying your employment and role

- If you’re retired, unemployed, self-employed, etc, you can simply produce a letter stating your situation. A lawyer can certify it if needs be.

- Proof of source of funds

- This is a legal KYC/AML (Know your customer / Anti-money laundering) requirement

- Paperwork to demonstrate how you came to be in possession of the capital to be invested

- Normal examples include recent payslips; confirmation of sale of assets (stocks, real estate, etc); proof of loan; proof of inheritance

- Clean Criminal Record in your home country

- The system is different in every country and in some, countries this can take a few weeks to obtain

- In order to legalize it across jurisdictions, the certificate needs an apostille stamp if your home country is part of the Hague Apostille Convention (What is the Hague Apostille convention?). This can also take several weeks.

- If you have moved country in recent years you will also need to complete this process for the previous country you lived in

- Must be less than 3 months old

Pro Tip

This final document - the clean criminal record - is usually the slowest to obtain. It also requires an apostille stamp meaning the whole process can take 2 or 3 months. It is advisable to apply for this before doing anything else so this slow timeline is ticking away in the background as you consider your options and then proceed through NIF and bank account opening processes.

Step 2: Hire a Lawyer in Portugal

Hopefully, you’re convinced by now of the value of having a reliable lawyer by your side

If you haven’t already, we recommend reading the section above on choosing a law firm.

Step 3: Get a NIF (Portuguese Fiscal Number)

A NIF is a Portuguese tax identification number. You need one in order to open a bank account (which you are obliged to do) so this is a requirement.

Usually, your lawyer will do this for you as lawyers have special channels into the Autoridade Tributária (Tax Authority), and ultimately you’ll need someone to be your tax representative in Portugal, which they’ll also bolt-on as a service. Paying a lawyer to do it is not the cheapest way (you’ll pay about €500) but it is the most predictable and least stressful route.

For those who want to do it cheaper you can come to Portugal and visit “Finanças” (local tax office) in person and do it yourself, Or, you can hire a low-cost operator to do it for around €150, although they won’t be able to be your tax representative in the long run.

Pro Tip

Your NIF must have an address associated with it. If you give an address in Portugal you are - often unwittingly - declaring yourself as a tax resident in Portugal. I have seen many people do this by accident. It’s an absolute nightmare to reverse. (This is a great example of the kind of thing that can subtly catch you out if you don’t use a lawyer.) So make sure you give an overseas address! If you want to become a tax resident in Portugal later on, the process is easy.

Pro Tip

At the moment you can still get a NIF in less than a week in Madeira if you hire a firm that has an office there. In mainland Portugal (particularly in the cities) it can take a few weeks.

Step 4: Open a Portuguese Bank Account

Most Golden Visa investors will choose to open their bank account remotely, which takes much longer but is still by far the most popular option. As usual, your lawyer will handle the process for you, telling you the documentation you need for any given bank. The bank is required to complete a KYC (Know Your Customer) process for each investor. The whole process usually takes 2-4 weeks, assuming you complete and return the forms you’re given swiftly.

Pro Tip

In Portugal, your signature always has to match the signature on your passport. If it is different they will reject your forms and you’ll have to mail them again.

Pro Tip

In Portugal, everything is done with paper and ink. This means the standard process for doing things remotely involves printing, signing, and mailing your paper forms. However, if you provide your lawyer with Power of Attorney, they can do all the signing on your behalf here in Portugal. They usually don’t offer this as they don’t love doing it, but they will if you request it. So, save yourself the postal delays and costs.

For those who can get to Portugal, the process is quicker and easier in person. Meetings are about an hour long and assuming you bring the required documentation (the bank will inform you in advance but it’s usually just ID, NIF, an employment letter, and proof of address in your home country) you usually walk out with your bank account open.

Pro Tip

USA citizens who are investing in a Golden Visa Investment Fund must work with banks that are practicing FATCA compliance. At the time of writing these options are limited to Bison Bank, Banco Atlantico, and BiG (Banco de Investimento Global).

Step 5: Select Your Qualifying Investment

The right choice for you will depend on many personal factors. We’ve discussed the options at length in this article to help with your decision.

In summary, those looking for a financially regulated product with professional investment expertise and a choice of investment classes will probably be most comfortable skewing toward the funds. Review your options for Portugal’s Golden Visa Investment Funds.

Those for whom the ability to physically touch your investment matters above all else (or who were looking to purchase a holiday home in rural Portugal anyway) will likely skew towards purchasing real estate. Review your options for Golden Visa Real Estate.

Step 6: Complete Your Qualifying Investment

As with earlier steps, your lawyer will guide you through this. Exactly what needs doing depends on the type of investment you’re making. In the case of funds, this is simply a bank transfer, with no taxes involved.

In the case of purchasing real estate, there will be additional documents to sign and notarize in Portugal as part of the property ownership transfer process. You will also have to pay property transfer tax and stamp tax totaling approximately 6.5% of the purchase price.

Step 7: Submit Initial Portugal Golden Visa Application

This is a step for which it is very strongly advised to ensure you are using a lawyer who has completed this process many times before.

Your lawyer will collect all the relevant documentation (much of which is technical and we haven’t mentioned it here as you will not personally have to source it), and review your entire application prior to submission.

It is your lawyer's responsibility to ensure the application they send meets all the requirements. This is why it’s so important to use a team who have completed this process hundreds of times before.

Step 8: Complete SEF Biometrics Appointment

It usually takes SEF about 2 months to review the application after which your lawyer can book a biometrics appointment with the SEF. COVID had a very disruptive effect on this timescale although it does now seem the SEF is getting close to resuming normal service.

You will need to attend the biometrics appointment in person, along with any family members who are included as part of your application, so make sure to discuss with your lawyer when you are available to visit Portugal.

You will attend the relevant office - your lawyer should accompany you there - where the SEF will take your photograph and fingerprints, and make your application official.

Approximately 4 months later you and your family members will receive a plastic card which is your residency permit - this is your Portugal Golden Visa! Parabéns!! (Congratulations!!)

Step 9: Complete Portugal’s Golden Visa Renewals

You guessed it - your lawyer will control this process for you.

Each plastic residency card is only valid for 2 years, after which you must renew your Portuguese Golden Visa. This process involved the SEF reviewing your case and ensuring you continue to meet the requirements. In practice, this means you must not have divested from your qualifying investment, and you will also submit proof that you and each family member on your visa have spent the required number of days in Portugal (14 days within the 2-year period).

A renewal is required at the end of your 2nd year and then another at the end of your 4th year.

Step 10: Application for Portuguese Citizenship

Fast forward 5 years and you have completed the residency requirement to make an application for Portuguese citizenship!

There are other requirements that must also be met. Most notably you will be required to pass a basic Portuguese language test to an A2 standard (think: a simple exchange at the supermarket checkout).

The application for citizenship takes 6-12 months. Once you have your passport in your hand, you can exit your investment and the process is complete!

And... Congratulations!!

Having completed these 10 steps, you are now a fully-fledged Portuguese citizen and a citizen of the European Union, free to live and work in 26 countries across Europe, and free to travel visa-free to 165 countries around the world.

🎁

This is a gift you can now give to all future generations of your family.